Money Magazine - EWallets - New Way To Cut Down Expenses

This year, the RBI granted licences for payment banks to 11

entities. As e-wallets are expected to play a key role, you can start using

these for discounts, cashbacks and other incentives. This, even as players like

Paytm, PayU and Mobikwik are already offering significant cashbacks.

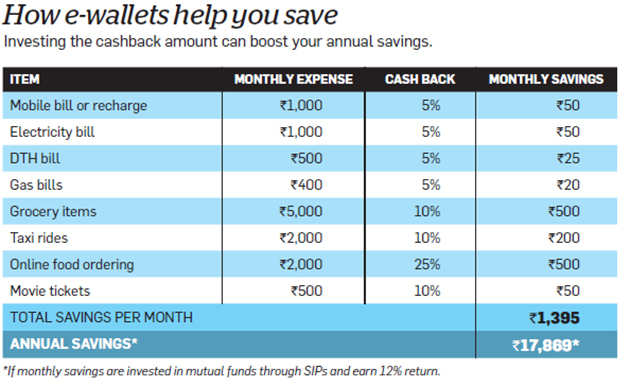

Some financial planners believe that ease of online transaction and heavy discounting have led to a rise in discretionary expenses. "We have seen budgets for food and clothing increase two-fold in the past two years," says Priya Sunder, Director, PeakAlpha, a wealth management firm. However, there are incentives even for essential household expenses like grocery, Internet, DTH and mobile bills (see table). Other categories include taxi rides, movie tickets, online shopping, food orders, hotel bookings, and flight, train and bus tickets. There are monetary rewards for referring others as well.

The

wallets—in which you can put in Rs 10-10,000—also offer security, a concern in

online transactions. "They are safe, convenient and rewarding," says

Abhijit Bhave, CEO, Karvy Private Wealth Management. The sites maintain the

same security level as that for any other banking transaction and you can limit

your loss by putting less money in the account. The only limitation is that

they are semi-closed, which means you can transact only online on limited

partner sites. Some financial planners believe that ease of online transaction and heavy discounting have led to a rise in discretionary expenses. "We have seen budgets for food and clothing increase two-fold in the past two years," says Priya Sunder, Director, PeakAlpha, a wealth management firm. However, there are incentives even for essential household expenses like grocery, Internet, DTH and mobile bills (see table). Other categories include taxi rides, movie tickets, online shopping, food orders, hotel bookings, and flight, train and bus tickets. There are monetary rewards for referring others as well.

Comments